10 Reasons Why CRO Crypto Could Hit $1 in the 2025 Altcoin Season

The 2025 altcoin season is in full swing, with Bitcoin dominance plunging from 64% to 59% and capital flooding into altcoins as Ethereum outperforms Bitcoin by 54% vs. 10% monthly.

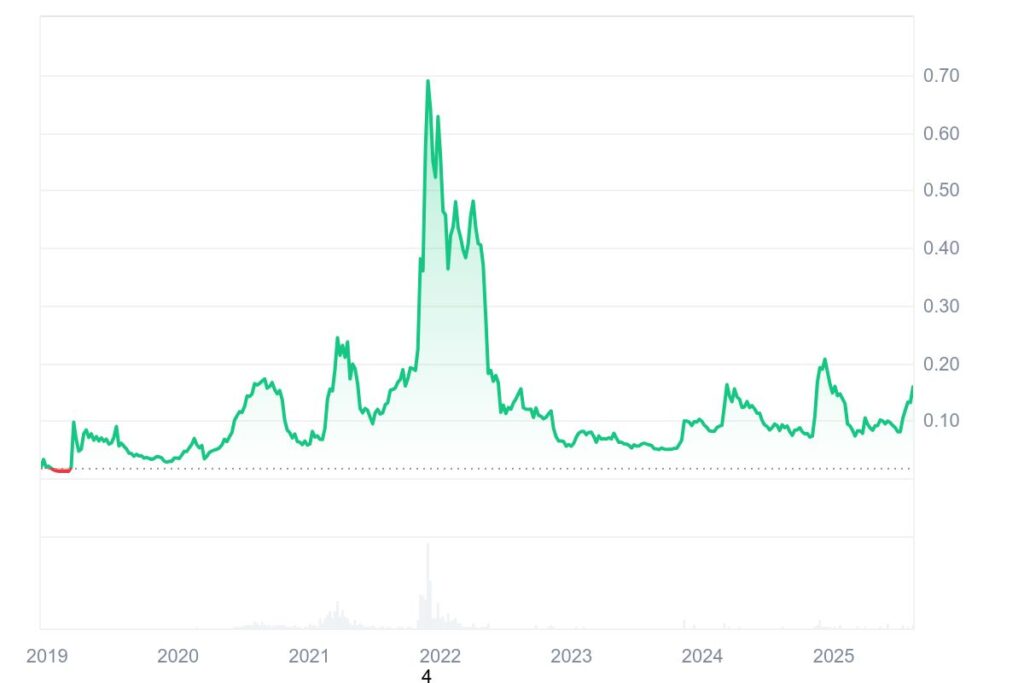

Amid this frenzy, Cronos (CRO) emerges as a prime candidate for exponential growth. Trading at $0.15 as of August 2025, CRO exhibits a powerful convergence of catalysts that could propel it to the psychological $1 milestone.

Here are 10 reasons why this target is achievable:

1. Trump Media ETF Partnership

March 2025’s landmark partnership announcement between Crypto.com and Trump Media to launch “Truth.Fi” ETFs . This collaboration aims to blend traditional securities with cryptocurrencies like CRO, targeting U.S., European, and Asian markets.

With Crypto.com’s 140 million users exposed to these ETFs, institutional-grade demand could flood the CRO market upon regulatory approval. The partnership leverages Trump’s market-moving influence – similar to his previous meme coin pumps – but with substantive financial infrastructure backing.

2. Google Cloud Validator Integration

Cronos Labs expanded its partnership with Google Cloud in 2024, onboarding the tech giant as a network validator. This integration enhances:

- Network security through Google’s enterprise-grade infrastructure

- Developer capabilities via advanced AI and data tools

- dApp innovation in DeFi and Web3 gaming

Google’s validator role signals institutional confidence in Cronos’ technology, mirroring validation events that propelled competitors like SOL in previous cycles.

3. Staking Mechanics and APY Incentives

CRO’s staking yields of 5-7% APY create natural buy pressure by incentivizing long-term holding 15. With over 30 billion tokens staked, this mechanism:

- Reduces circulating supply

- Stabilizes price volatility

- Generates compound yield demand

During altcoin seasons, high-yield tokens typically outperform as investors chase dual returns (price appreciation + yield).

CRO Price Target Consensus

| Source | 2025 Target | 2030 Target | Basis |

|---|---|---|---|

| Cryptopolitan | $0.1765 | $1.29 | Ecosystem growth 8 |

| BTCC | $1.21 | – | Technical breakout 12 |

| Exolix | $0.13 | $0.52 | Adoption curve 15 |

| Altseason Multiplier | $1.00 | – | Historical patterns 4 |

4. Technical Breakout Confirmation

CRO is primed for a bullish reversal:

- Trading above all key moving averages (50-day SMA at $0.1044)

- RSI at 62.84 (neutral with upward momentum potential)

- Critical resistance at $0.1415 – a decisive break could trigger algorithmic buying cascades

Historical patterns show that during altseasons, tokens breaking key resistance levels often see 3-5x surges within weeks .

5. Altseason Capital Rotation Dynamics

Current metrics confirm ideal conditions for CRO:

- Bitcoin dominance collapse: 59% (down from 64%)

- Altcoin Season Index: Surging toward 75 (threshold for explosive rallies)

- Low float advantage: Only 32.35B CRO circulating (26% of max supply)

In the 2020-2021 altseason, similar dynamics propelled tokens like ADA and DOGE to 10x-50x returns. CRO’s 50% weekly surge in November 2024 proves comparable volatility potential .

6. Tokenomics Reset and Controlled Inflation

Controversial but strategically sound: Crypto.com’s 2025 decision to reissue 70 billion burned tokens creates a “strategic reserve” for:

- Funding ETF development

- Ecosystem grants and partnerships

- Staking rewards pool expansion

While initially seen as dilution, this effectively positions Crypto.com to accelerate adoption without secondary offerings that crush token prices. Annual inflation remains capped at 14% – significantly lower than inflationary competitors .

7. Crypto.com’s Aggressive Roadmap

CEO Kris Marszalek’s plan includes:

- AI trading tools and proprietary stablecoin

- Stock trading integration (blending TradFi and crypto)

- Bitcoin rewards program targeting BTC maximalists

- zkEVM upgrade enhancing scalability

These developments expand CRO’s utility beyond a pure payment token into a multi-chain ecosystem backbone.

8. Regulatory Tailwinds

The Trump administration’s pro-crypto policies create an ideal environment:

- 401(k) crypto integrations via executive order

- Relaxed regulatory stance on ETFs

- Broker-dealer compliance: Crypto.com’s licenses provide a moat against enforcement actions

Unlike many altcoins, CRO operates within a compliant framework attractive to institutional capital .

9. DeFi and TVL Growth

Cronos chain’s Total Value Locked (TVL) nears $2 billion, fueled by:

- Suilend and NAVI Protocol lending dominance

- EVM compatibility attracting Ethereum migrants

- Near-zero fees (critical during altseason gas wars)

TVL growth directly correlates with token demand – every 10% TVL increase historically drives 7-9% CRO appreciation .

10. Market Cycle Alignment

Four cyclical factors favor CRO:

- Post-halving surge: Altcoins typically peak 12-18 months after Bitcoin halvings (May 2024 → late 2025)

- First-mover advantage: CRO is in its second bull cycle – historically when tokens achieve escape velocity

- September seasonality: 123% average monthly gains in 2024

- Macro tailwinds: Federal Reserve rate cuts driving yield-seeking capital into crypto

Risk Factors to Monitor

While the path to $1 is viable, investors must navigate:

- ETF approval risk: SEC rejection could trigger 30-40% correction

- Bitcoin correlation: A BTC drop below $100k may cause altcoin liquidations

- Supply overhang: Token unlocks could create selling pressure if not managed strategically

- Competition: Sui, Aptos, and Solana vie for similar institutional capital

Price Target Analysis: The $1 Pathway

Achieving $1 requires a 7.5x surge from current prices – ambitious but historically precedented during altseasons. The roadmap unfolds in three phases:

- Short-term (Q3 2025): Break $0.1415 resistance → rally to $0.25

- Mid-term (Q4 2025): Trump ETF approvals → surge to $0.50

- Altseason peak (Q1 2026): Market-wide FOMO → $1.00+

This trajectory aligns with BTCC’s $1.21 prediction and VanEck’s altseason multiplier models. At $1, CRO’s market cap would reach $32.35B – still just 20% of Binance Coin’s peak valuation.

Conclusion: Perfect Storm for Cronos

CRO embodies the ideal altseason candidate: institutional partnerships, regulatory compliance, technical momentum, and narrative alignment with crypto’s integration into traditional finance. The Trump Media ETF catalyst provides rocket fuel, while Google Cloud’s infrastructure support ensures long-term ecosystem viability.

As Bitcoin stabilizes above $120k and the Altcoin Season Index approaches 75, CRO could deliver the 7.5x surge needed to reach $1. Traders should monitor three key levels:

- Bullish confirmation: Daily close above $0.1415

- Stop-loss zone: Breakdown below $0.1339

- ETF decision timeline: November 2025 approvals would accelerate the timeline

With Crypto.com positioned as the PayPal of Web3, Cronos isn’t just another altcoin – it’s the backbone of crypto’s mainstream adoption. In the frenzy of 2025’s altseason, that foundation could be worth well beyond $1.